Saving money doesn’t have to mean cutting all the fun out of your life or living on instant noodles. In fact, some of the best money-saving habits are surprisingly simple and easy to stick with. The key isn’t how much you earn, but how well you manage what you already have. With a few smart money moves, you can start saving more every month without feeling overwhelmed.

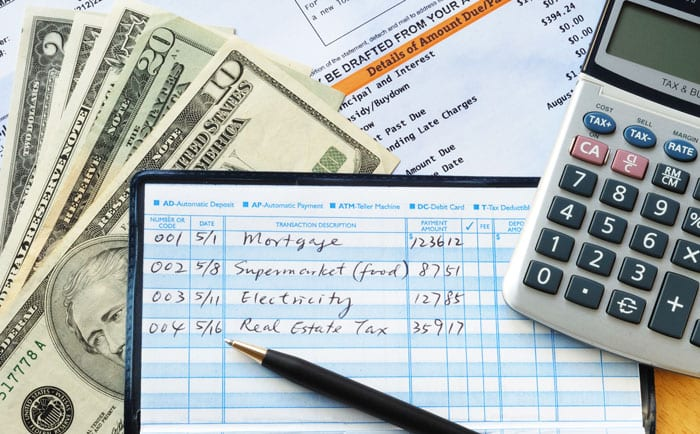

1. Know Where Your Money Is Going

One of the biggest reasons people struggle to save is because they don’t actually know where their money goes. Small daily expenses like coffee, snacks, or impulse online purchases quietly add up.

Take one month to track your spending. Write down everything or use a budgeting app. Once you see the patterns, it becomes much easier to spot areas where you can cut back without sacrificing your lifestyle.

2. Pay Yourself First

Most people try to save whatever money is left at the end of the month. The problem is that there’s often nothing left. A smarter approach is to save first.

The moment your income arrives, move a fixed amount into your savings account. Even if it’s small, consistency matters more than the amount. Over time, this habit builds a strong savings foundation.

3. Create a Simple, Realistic Budget

Budgeting doesn’t mean strict rules or guilt. It’s simply a plan for your money. A realistic budget should include essentials, savings, and some room for enjoyment.

Avoid complicated spreadsheets if they stress you out. A basic breakdown of needs, wants, and savings is more than enough to get started and stick with it long term.

4. Cut Costs Without Feeling Deprived

Saving money works best when it doesn’t feel like punishment. Instead of cutting everything, focus on smarter choices.

You might cook at home a few more nights a week, cancel unused subscriptions, or compare prices before buying. These small changes barely affect your daily life but can free up a surprising amount of money each month.

5. Set Clear Savings Goals

Saving without a goal can feel pointless. When you know what you’re saving for, motivation becomes much stronger.

Whether it’s an emergency fund, a vacation, or peace of mind, having a clear goal gives your savings purpose. Break big goals into smaller milestones so progress feels achievable and rewarding.

6. Avoid Lifestyle Inflation

As income increases, spending often increases too. This is known as lifestyle inflation, and it’s one of the biggest obstacles to long-term savings.

When you earn more, try to save more instead of spending more. Enjoy improvements in your life, but don’t let every raise disappear into higher expenses.

7. Review and Adjust Every Month

Life changes, and so should your money plan. Take time each month to review your spending and savings.

If something didn’t work, adjust it without guilt. Saving money is a learning process, not a test you either pass or fail.

Final Thought

Saving more money doesn’t require extreme sacrifices or financial expertise. It’s about making small, smart decisions consistently. When you focus on progress instead of perfection, saving becomes a natural part of your life. Over time, these simple money moves can bring you financial confidence, security, and freedom.

This content is for informational purposes only and should not be considered financial advice. Individual financial situations vary, and readers are encouraged to consult a qualified financial professional before making financial decisions.

#MoneyManagement #SmartSaving #PersonalFinance #SavingsTips #FinancialWellbeing #BudgetingBasics #MoneyGoals #Anslation #Carrerbook