Money affects nearly every part of our lives, yet many of us are never taught how to manage it properly. We learn through trial and error, often after making mistakes that could have been avoided. Long-term financial success is not about earning a massive salary or chasing quick wins. It is about building consistent habits, making thoughtful decisions, and understanding how money works over time.

This guide breaks down money and savings in a realistic, human way—focused on progress, not perfection.

Understanding Your Relationship With Money

Before saving or investing, it helps to understand how you think about money. Some people see money as security, others as freedom, and some as a source of stress. Your habits are often shaped by upbringing, past experiences, and financial pressure.

Be honest with yourself. Are you someone who avoids checking bank balances, or someone who tracks every expense? There is no right or wrong answer, but awareness is the first step toward improvement.

Why Saving Matters for the Long Term

Saving is not just about emergencies. It gives you choices. When you have savings, you are less likely to rely on debt, panic during unexpected events, or feel trapped in unhealthy financial situations.

Long-term savings allow you to:

- Handle medical or personal emergencies

- Plan for major life goals

- Reduce financial stress

- Prepare for retirement with confidence

Even small, regular savings can grow into something meaningful over time.

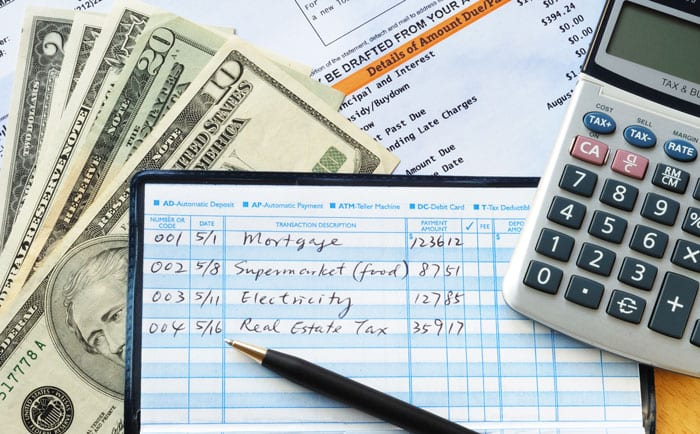

Creating a Budget That Actually Works

A budget should support your life, not restrict it. The best budget is one you can stick to without feeling deprived.

Start by tracking where your money goes each month. Once you understand your spending patterns, organize your income into basic categories such as needs, savings, and lifestyle expenses.

Flexibility is key. Some months will cost more than others, and that is normal. A realistic budget adapts to life instead of fighting it.

Building a Consistent Saving Habit

Consistency matters more than amount. Saving a small percentage of your income regularly is far more effective than saving large amounts occasionally.

Helpful ways to build the habit include:

- Automating transfers to a savings account

- Saving first, then spending what remains

- Increasing savings gradually as income grows

- Keeping savings separate from daily spending accounts

Over time, saving becomes routine rather than effort.

Emergency Funds: Your Financial Safety Net

An emergency fund protects you from unexpected expenses like job loss, car repairs, or medical bills. Without one, people often turn to credit cards or loans, which can create long-term financial strain.

A good goal is to save three to six months of essential expenses. This may take time, and that is okay. What matters is steady progressure goals.

Growing Your Money Over Time

Saving alone is not always enough to beat inflation. Long-term success often includes investing, even in small amounts. You do not need to be an expert to get started, but you should understand the basics.

Long-term investing works best when it is:

- Patient

- Consistent

- Based on realistic goals

- Aligned with your risk tolerance

The earlier you start, the more time works in your favor.

Setting Financial Goals That Motivate You

Clear goals give your money a purpose. Whether it is buying a home, traveling, starting a business, or retiring comfortably, goals help guide decisions.

Break long-term goals into smaller steps. This makes progress visible and keeps motivation high, even when the journey feels slow.

Staying Consistent Through Life Changes

Life will change. Jobs shift, families grow, priorities evolve. Long-term financial success comes from adjusting your plan without abandoning it.

Review your finances regularly, especially after major life events. Small adjustments can keep you moving forward without starting over.

Final Thoughts

Money and savings are not about perfection. They are about awareness, patience, and consistency. You do not need to have everything figured out today. What matters is building habits that support your future self.

Long-term success comes from showing up for your finances regularly, learning from mistakes, and staying committed even when progress feels slow.

This content is for educational and informational purposes only and does not constitute financial, investment, or legal advice. Financial decisions should be made based on individual circumstances. Readers are encouraged to consult qualified financial professionals before making major financial decisions.

#MoneyAndSavings #FinancialSuccess #PersonalFinance #SmartSaving #WealthBuilding #FinancialFreedom #MoneyManagement #LongTermPlanning #Anslation #Carrerbook